Dollar Exchange Rate Estimation in the Context of Slumping Economy. The rouble is a victim of the debt burden, not just the falling oil prices.

Rusmet claims that the government has to reset the

refinancing rate and take people’s debts upon itself. These measures are to become

the emergency aid that will reanimate the Russian system of finance, which is

swiftly plunging into a chain of payment failures. By 2014 the total debenture rate

had grown up to 13% of GDP. Debtors have nowhere to get money from for their

paybacks, while the actions of debt collectors cause murders and suicides.

A bad

but live bank is better than a good line of anxious people, taking back their

deposits. What is the basic difference between any citizen of Russia and the

small group of people who are promised to be recompensed by the government for

their losses caused by the sanctions? Everyone is affected, so everyone needs

protection.

1.

Devaluation will not

lead to the recurrence of 1998.

High interest rates have made debtors seek a

better life abroad. They have, obviously, “found” it, in this way, setting a

record in the last 15 years. On 1 July 2014 the amount of corporate debts

exceeded 675 billion dollars. In the following 6 months Russia had to pay out

the peak total of 106 billion dollars, 30 of which was paid out in December

2014. It would have been no big deal, but one by one western countries started

to impose sanctions that would set up barriers in the way of new loans. In this

context oil prices are rolling down and pulling along the rouble. It is

important to understand that the rouble devaluation in 2014 will not lead to

the recurrence of the situation back in 1998. Yesterday the devaluation gave a

second breath to industry, and today the burden of the dollar exchange rate

growth lies heavy on our businesses. It happens due to the fact that the

foreign currency debt in this period has grown 15 times: having had no debts

before, now businesses have debts that exceed their annual revenues. But for

China, it would not cause any problems: the goods could be sold for dollars

which would subsequently be used to pay back debts. However, nowadays there is

a war for the customer on the traditional international market.

The credit debts of people are the

government’s debts, because it was the government that allowed consumer credits

at such rates that had better be called the legalized looting of people. It was

the government that stimulated the appearance of debt collectors who are

nothing but cowards having enough courage just to threaten single mothers and

weak pensioners. The interest of 37.5% is not uncommon even for such banks as

VTB-24. The rates of 80% and more, covered by various commissions and words in

small print have become the talk of the town. Since 2006 the number of consumer

credits has grown 10 times – from 1 to 10 trillion roubles. Simultaneously, in the situation where people lack money, for more than a

year banks have been reluctant to extend credits, as a result, stimulating the

growth of non-bank microfinancing with its yobbish debt collectors.

2. Dollar Exchange Rate

Estimation in 2015.

So, the government is saving banks using emergency

measures and breaking chains of payment failures. Now it makes sense to estimate the dollar

exchange rate. For the reasons of national safety Russia has to reach such a

state of economy when nobody will care about the euro or dollar rates. But

somehow the dollar rate never seems to go where we need it; it goes where the

USA needs.

Rusmet expects

the Russian exchange market to rally in March, and the first signs of recovery

to appear after a month. In the first place, it is connected with Russia’s payoffs

of the external debt which by 90% consists of the debts of banks and

businesses. Encouraged by panic fears, the dollar rate will have risen above 65

roubles by February 2015. But this will be a temporary situation because in the

next few months the equilibrium value will make 57 roubles. The lowering will

begin in February or March having reached the equilibrium value of 45 roubles

by the middle of the next year.

The existing system of finance in Russia is extremely

imperfect; not only is it inconsistent with the task the government is facing,

but it also serves somebody else’s interests. For this reason, everything is divided

into 2 parts. Every day in currency exchange offices we can see the unfair dollar

rate, which reflects the moods of currency speculators as well as the financial

state of Russia, but not Russia’s economic potential or its richest natural resources

in the world. A fair rate can and must be set according to a clear reference

point. Such reference point for industry is the cost of one kilowatt of energy.

2.1. Unfair exchange

rate. With reference to oil prices in December dollar cannot cost more than 50

roubles 80 kopecks.

Many people claim that the dollar exchange rate directly depends on oil prices.

Let us remember year 2008. In the middle of 2008 the price for oil reached its

peak of 143 dollars and then started to slump. On 5 December the price for oil fell

lower than 40 dollars per barrel. The dollar rate increased from 23 roubles in

July 2008 to 36 roubles by the beginning of February 2009. Having solved a simple

proportion we will get the true present figures. If the situation of 2008 with similar

inertial-panicky moods of people was to repeat, the dollar rate in December

would make 49.5% having risen to 50.8% by the beginning of 2015. However, the rate

for 8 December amounted to 53 roubles 30 kopecks, and after a day it became more

than 54 roubles.

Comparison of foreign currency rates and oil prices in 2008 and 2014.

|

|

2008, July

peak |

2008, December - February 2009 | Change from peak value |

2014, July |

2014, December (Data for 8 December) |

Change from peak value |

| Oil price, USD/barrel |

143,19 peak |

39,29-45,9 | -73 % |

114,17 peak |

67,4-73,4 | -58 % |

| 1 dollar rate, rur. |

23,19 minimum |

27,9-36,2 | +64% |

33,63 minimum |

51,8-54 | +61% |

2.2. Unfair exchange rate. Russian debt burden provides new exchange course 57 roubles 93 kopecks.

It happened so that the finance system in Russia and in the world got separated from the economy. Russia’s external debt on 1 July 2014 amounted to 734 billion US dollars, whereas on 1 October it was 678 billion dollars. Having studied the schedule for the external debt repayment we find out that from 1 July to 21 December 2014 the amount of payments was 50% higher than the 6-month similar figure in 2009. In one year, from 1 June 2014 to 30 June 2015 Russia will have to pay back 161 billion US dollars, and in more than 2 years it has to pay back 390 billion dollars. Only then it becomes evident to what extent the sanctions have influenced Russia.

Russian external debt, billions US dollars, according to data and estimates of the Central Bank of Russian Federation, by reference to debt payment schedule.

| 1998 | 2008, October | 2009, January | Change | 2014, July | 2015, January | Change | |

| Collective debt | 182,8 | 540,8 | 463,9 | -76,9 | 734 | 628 | -106 |

| National debt | 136,4 | 32,6 | 29,4 | -3,2 | 59 | 57,7 | -1,3 |

| Corporate debt and banks | 46,4 | 508,2 | 434,5 | -73,6999999 | 675 | 570,3 | -104,7 |

However, there

is some optimistic news. In January 2015 the payment will be 6 times smaller

than in December, and the total payment for the first half of 2015 will be 6

times lower than in the previous 6 months – just 55 billion 378 million US

dollars. In the second half of 2015 it is going to be even smaller – 46

billion, whereas the total payment in the first half of 2016 will amount to 37

billion dollars.

Since 2008 the amount of cash and money remaining on the correspondent accounts

has increased twice. In this context by the middle of 2014 the amount of deposits

had reached its peak of almost 30 trillion roubles, which amounted to nearly

half of Russia’s GDP at the summer exchange rate. The deposits by individuals and

businesses came to 17 and 11 trillion roubles correspondingly. Notably, foreign

currency deposits with individuals made 17.6%, whereas with businesses - 40,9%.

What comes to loans, there is the inverse correlation: the amount of consumer

credits is 10 trillion roubles, while corporate credits make 20 trillion

roubles.

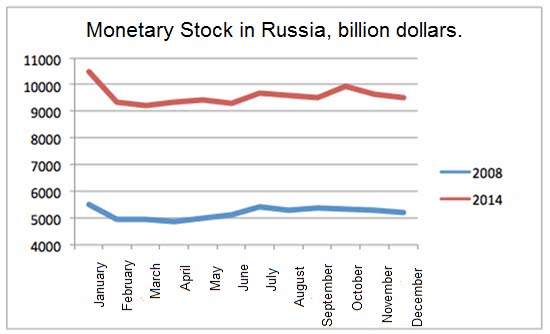

Rouble monetary

stock in Russia, data of the Central Bank of

the Russian Federation

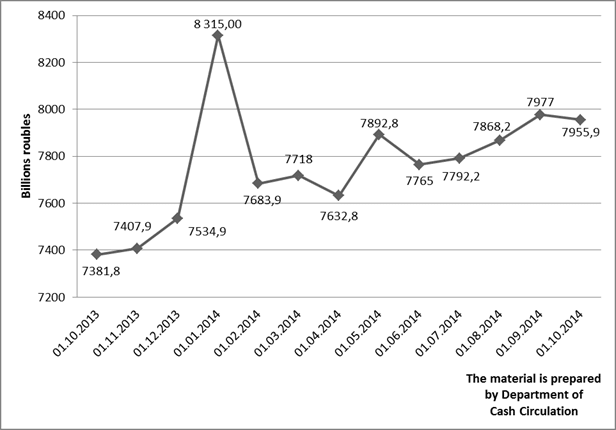

Broadly-defined monetary base in 2014, billions roubles, data of the Central Bank of Russia

|

Month number,

2014 |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| Monetary base (in broad definition) | 10 503,9 | 9 351,2 | 9 230,1 | 9 344,7 | 9 427,9 | 9 326,1 | 9 672,4 | 9 613,5 | 9 537,2 | 9 947,9 | 9 646,4 |

| _cash in circulation with regard to the remaining balance in cash desks of credit organisations1 | 8 307,5 | 7 672,1 | 7 706,2 | 7 620,7 | 7 881,2 | 7 752,9 | 7 779,9 | 7 856,3 | 7 965,3 | 7 943,8 | 7 999,0 |

| _correspondent accounts of credit organisations in the Bank of Russia2 | 1 270,0 | 1 141,9 | 1 001,1 | 1 162,6 | 1 016,4 | 1 050,3 | 1 371,5 | 1 218,3 | 989 | 1 358,6 | 1 070,9 |

| _required reserves3 | 408,8 | 411,3 | 415,8 | 442,7 | 431,8 | 434,8 | 432,1 | 431,1 | 448,8 | 429,4 | 435,1 |

| _deposits of credit organisations in the Bank of Russia | 517,6 | 126 | 106,9 | 118,7 | 98,5 | 88,1 | 89 | 107,8 | 134 | 216,1 | 141,4 |

| _bonds of Bank of Russia held by credit organisations4 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Cash in circulation in Russia, data of the Central Bank of Russia

Structure of Cash Holdings in Circulation on 1 October 2014

Value, number and proportion of coins and bank notes in circulation

| Bank notes | Coins | Total | |

| Value (billions of roubles) | 7 880.3 | 75.6 | 7955.9 |

| Quantity (millions of items) | 5 871.0 | 59 698.0 | 65 569.0 |

| Proportion in value (%) | 99.0 | 1.0 | 100.0 |

| Proportion in banknotes (%) | 9.0 | 91.0 | 100.0 |

| Change since 1.01.14 (billions of roubles ) | -366.3 | 7.2 | -359.1 |

| Change since 1.01.14 (%) | -4.4 | 10.5 | -4.3 |

Change of cash amount in circulation

2.4. Fair dollar exchange rate – 7 roubles.

It is unprofitable for industry to have a high exchange rate. However, what rate

is fair in Russia, unless you take into account the sick imagination of

currency profiteers?

A certain reference line needs to be used. Such line can be the price for

energy, the prime cost of one kilowatt. The prime cost differs a lot according

to the type of energy. The least expensive types are coal and hydro energetics.

Then come nuclear power, gas, wind power and solar power.

In the USA the prime cost lies within 0.04 and 20 cents. The lower limit is constituted

by water power, the segment which takes 6% of total amount. The average figure is

10 cents. In Russia the prime cost differs from 50 kopecks to 6 roubles. The

upper limit of 6 roubles per a kilowatt is formed by the diesel generator with

the capacity of 12 kilowatt/hour (2.2 litres per hour). It is obvious that diesel

oscillation comprises less than 1% of the total amount of energy (water power

makes 17%). The average prime cost of energy in Russia is not more than 70

kopecks.

70 kopecks equals to 10 cents, which means that the fair dollar exchange rate

makes 7 roubles.

Experts will swiftly point out that such a course is unacceptable, that they

will not survive. They will be right, if we take into consideration the present

structure of economy.

|

Export |

Import |

|

Energy resources: oil, gas, coal Raw materials and consumables: iron stone, scraps, aluminium ingots, mineral fertilizers, grain…. Human capital assets |

Ready-made foods

Consumer goods (electronics, cars, furniture, cutlery) Pharmaceutical products Machinery and industrial equipment |

| Cash |

In the international

trade all prices are in dollars and they are independent from Russia. It is a nice

market, isn’t it? You come to a market, take everything you want and pay for it

in the way you wish. Or you do not pay because you have left your wallet at home

– the sellers will give away everything with pleasure. The world is ready to sacrifice

Russia as a sales area if as a result they will get cheaper prices for energy

resources. And if the commodity assets are exchanged for outstanding debts, the

creditors will be over the moon: the weak rouble plays into their hands.

The situation is worsening due to the fact that while by some companies export goods,

it is entirely different companies that consume the imported goods in Russia.

The latter usually have nothing to do with export but they, nonetheless, suffer

from currency fluctuations.

3. Russia’s upcoming actions.

Chinese companies, even extractive ones, predict what the situation will be 100

years from now. For them the planning horizon of 2020-2030 is short-term.

Nowadays China beats its opponents at most markets, forcing out traditional

suppliers. Turkey has always been known to earn good money using its

geographical position, but it is also in a plight these days. The fact, that

the modern processing plants are built close to ports and the logistic prime

costs are minimal, does not improve the situation. These plants are closing

down or they are on the verge of shutting down because of China. There is one

more reason, however: they do not have their own energy carriers, which adds to

the prices.

Strangely enough,

in this background Russia is desperately trying to save its part of the world’s

oil market. It looks as if Russia is begging other countries to take oil and

gas. But why? We need these energy carriers ourselves.

Russia does not need

the abstract “import substitution”, but needs the real production of goods,

which will be vital in the next 100 years. In order to do this we need a new

system of finance that would serve the interests of manufacturers.

The present

system of finance has reached the point of no return. Unless we change it we

are guaranteed to face bank failure. Only the banks that will gain the

governments support will survive. The total financial debt of individuals

exceeds 10 trillion roubles. The average interest rate for individuals is 30%.

This figure takes into account the mortgage rate of 12-16%. It is also

necessary to take into account microfinance and unofficial credit activities

which, by a modest computation, go beyond 1 trillion roubles with the interest

rate of 80%. The corporate debt amounts to 20 trillion roubles. The average

interest rate for businesses is 15%. Then, speaking about the external debt,

its average interest equals to 5%. Here we are speaking about the total amount

that includes commissions and various service charges. Now let us estimate the

interest Russia has to pay annually.

Consumer credits

10 x 30% + commercial borrowings 20 x 15% + microfinance 1 x 80% + external

corporate loan at the current rate of 1,7 = 8 trillion 527 billion roubles.

In 2013 the nominal

volume of Russian GDP amounted to 66.7 trillion roubles. It means that debenture

interests are almost 13 per cent. Where are we supposed to take them?

When western financiers

keep the refinancing rate close to zero, it does not mean that they are industrial

patriots or that they are less avaricious than ours. The thing is that they have

studied numbers at school, so they understand that the high interest rate is

barely noticeable for the economy when credit activities are comparatively

small. As soon as the amount of debts becomes proportionate to the GDP, however,

any borrowing rate will lead to bankruptcies of businesses and even whole

branches of industry which will be unable to pay out debts. Businesses do not

print money, but they produce goods and services.

For the above-mentioned reasons, Russia urgently needs

to reset the refinancing rate to zero. Moreover, it is urgent that the

government takes upon itself solving the problem of individuals’ debts. This

would be an incommensurably smaller price in comparison with the one that the

government will have to pay in the near future, saving collapsing banks and

helping bigger businesses and one-factory towns to survive.

Your comment